"Supporting cancer research means bringing hope to patients and encouraging researchers by showing them that we believe in them. I'm not a doctor, nor a nurse, nor a researcher... my only power is to help cancer research financially. Ma, our responsibility is to do everything we can, so that one day, cancer will be nothing but a bad memory!"

Madeleine

Cancer affects us all

With an estimated 433,000 new cases in 2023, cancer remains the leading cause of premature death in France. 1 in 2 men and 1 in 3 women will be affected during their lifetime.

Your generosity makes all the difference, and thanks to you, research and innovation are advancing for the benefit of all. Your help is a powerful gas pedal of progress, and we still need your help to advance research and beat cancer tomorrow.

of the research budget is financed by donations and bequests

million euros raised by 2023

research positions funded by donations and bequests

research teams

Want to support research at the Centre Baclesse? Here's how you can help:

Make a one-off or regular donation

Making a donation as part of the Impôt sur la Fortune Immobilière (IFI) (French property tax)

Donations made within the framework of theImpôt sur la Fortune Immobilière (IFI - French property tax) are a tremendous boost to the Centre Baclesse's research and care missions. Making an IFI donation is an opportunity for solidarity as well as for tax purposes.

This generous gesture allows you to support cancer research while significantly reducing your tax burden. By making a commitment to us, you are helping the 28,000 patients treated at the Centre Baclesse every year.

Why support us?

For over 100 years, the Centre Baclesse has been an expert in oncology, with a triple mission of care, research and teaching.

The Centre Baclesse is home to France's 1st laboratory for diagnosing genetic predispositions to breast and ovarian cancer.

At the Centre Baclesse, 300 professionals from 5 research teams are constantly contributing to the development of new knowledge essential to medical progress and improved care.

Income tax

- 66% of the amount of your donation is deductible from your Income Tax (IR) up to a limit of 20% of taxable income.

- Example: Your €100 donation comes to €34 after tax deduction.

Property wealth tax

- 75% of the amount of your donation is deductible from your Impôt sur la fortune immobilière (IFI), up to an annual limit of €50,000, i.e. a maximum donation of €66,667.

- Example: Your €10,000 donation comes to €2,500 after tax deduction.

Corporate income tax

- 60% of the amount of your donation is deductible from your Corporate Income Tax (CIT) up to a limit of 0.5% of your company's sales.

- Any surplus can be carried forward to the next 5 years.

- Example: Your €10,000 donation comes to €4,000 after tax deduction.

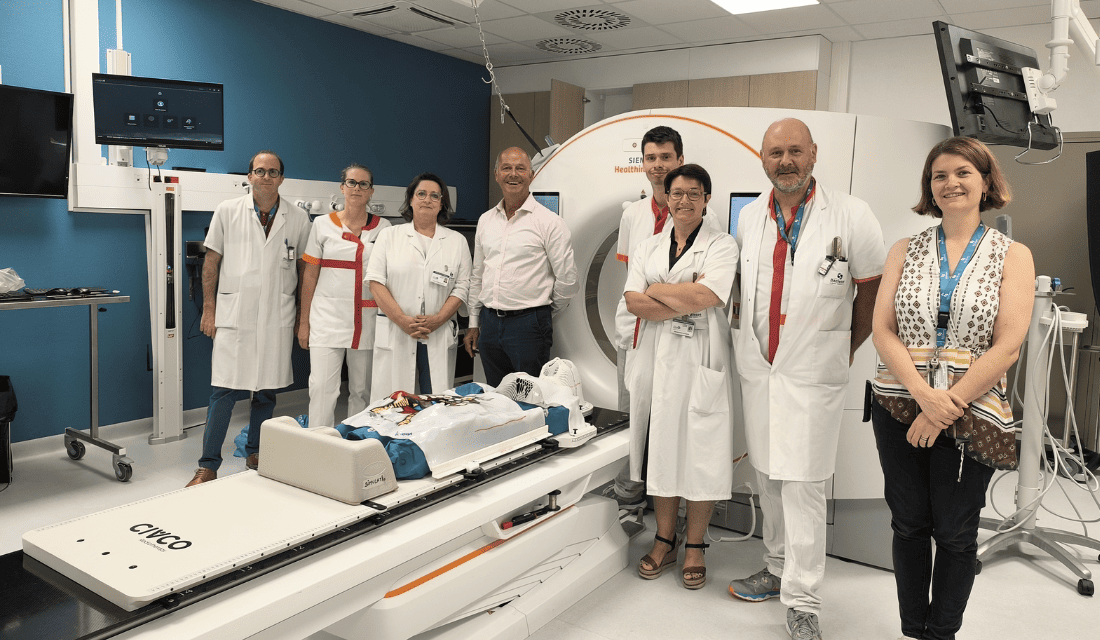

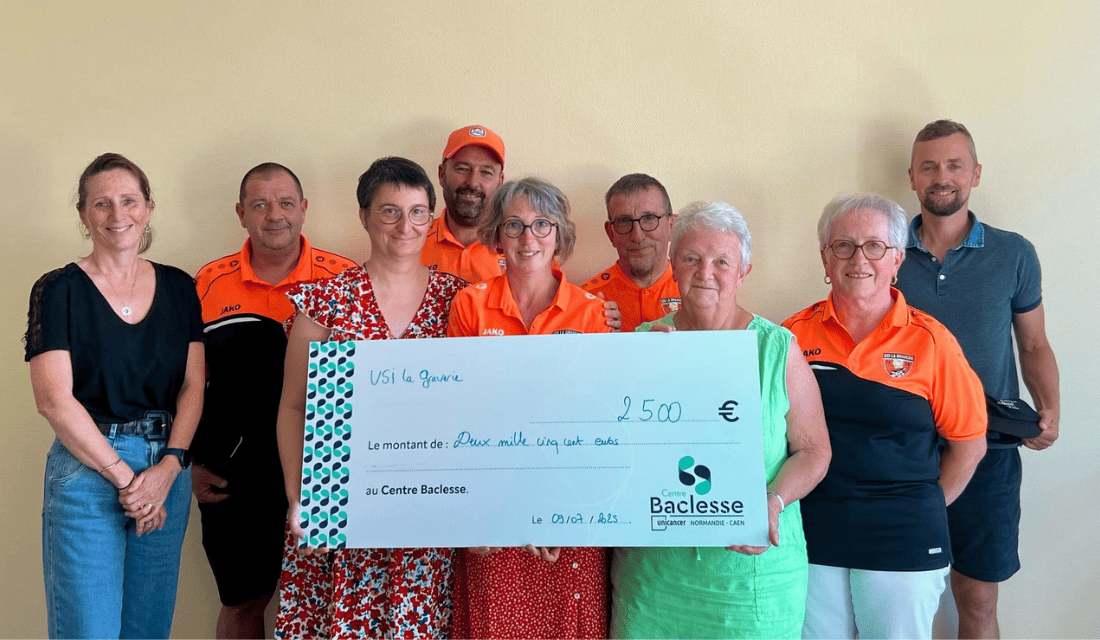

They support us

All donor newsEvery donation counts - they support us too!

Many of you are working alongside the Centre Baclesse to help patients in Normandy. Your donations are essential to accelerate cancer research and improve the comfort of patients and their families. Your generosity and solidarity are a precious source of hope and support in the fight against the disease.

The list is not exhaustive, and this page will evolve as your actions evolve.

THANK YOU SO MUCH!

Discover them in pictures!

View photo gallery Make a donation

Make a donation

Answers to your frequently asked questions

The donor area is your privileged space where you can manage your personal data.

In this personal area, you can :

- Download your duplicate tax receipts,

- View your donation history,

- Manage your regular direct debits (amount and frequency) and one-off donations,

- Update your postal and bank details.

If you have already made a donation :

- To access your personal space, follow the link in your login email

- If you don't already have it, open the following link: Support the Centre François Baclesse (iraiser.eu)

- Enter your email address to automatically receive the link to your personal space.

- Open the email and click on the login link, and you'll be automatically redirected to your personal space without having to remember an extra password.

Need help?

Please do not hesitate to contact Géraldine PAYEN, our Donations and Donor Relations Officer, by telephone on 02 31 45 86 88 or by e-mail: dons@baclesse.unicancer.fr

You can contact us on 02 31 45 86 88 or dons@baclesse.unicancer.fr.

If you send us an e-mail, please indicate :

- Your address

- The amount and date of your donation

- Your telephone number

This information will enable us to send you a duplicate by post or e-mail as quickly as possible.

Donations made to the Centre Baclesse should be entered on your tax return under " Other organizations of general interest " in box " 7UF ".

The tax benefit is the same whether you make a one-off donation or a regular donation. 66% of the amount of your donation is deductible from your income tax.

If you are liable for theImpôt sur la Fortune Immobilière (IFI), 75% of the amount of your donation is deductible from your IFI, up to a limit of €50,000.

The Centre Baclesse is authorized to receive corporate donations.

A company that makes a donation to the Centre Baclesse can benefit from tax deductions equivalent to 60% of the amount of its donation, up to a limit of 0.5% of its sales.

Recognized as a charitable organization, the Centre Baclesse is authorized to receive bequests, donations and life insurance policies exempt from all taxes and inheritance duties.

A notary is a legal specialist who can advise you on the best way to draw up a will. He or she will take into account your family situation and assets, and ensure that your will faithfully reflects your wishes.